Farm Equipment Tax Depreciation Life . used farm equipment has a gds recovery period of seven years which is unchanged from previous years. economic depreciation estimates the value of an asset, such as farm machinery, that is used for a farming operation. 100% depreciation in the first year. it is important for farmers to understand how these different depreciation methods can impact their tax burden throughout the. special depreciation allowance is 60% for certain qualified property acquired after september 27, 2017, and placed in service after december 31, 2023, and.

from www.slideserve.com

it is important for farmers to understand how these different depreciation methods can impact their tax burden throughout the. 100% depreciation in the first year. special depreciation allowance is 60% for certain qualified property acquired after september 27, 2017, and placed in service after december 31, 2023, and. economic depreciation estimates the value of an asset, such as farm machinery, that is used for a farming operation. used farm equipment has a gds recovery period of seven years which is unchanged from previous years.

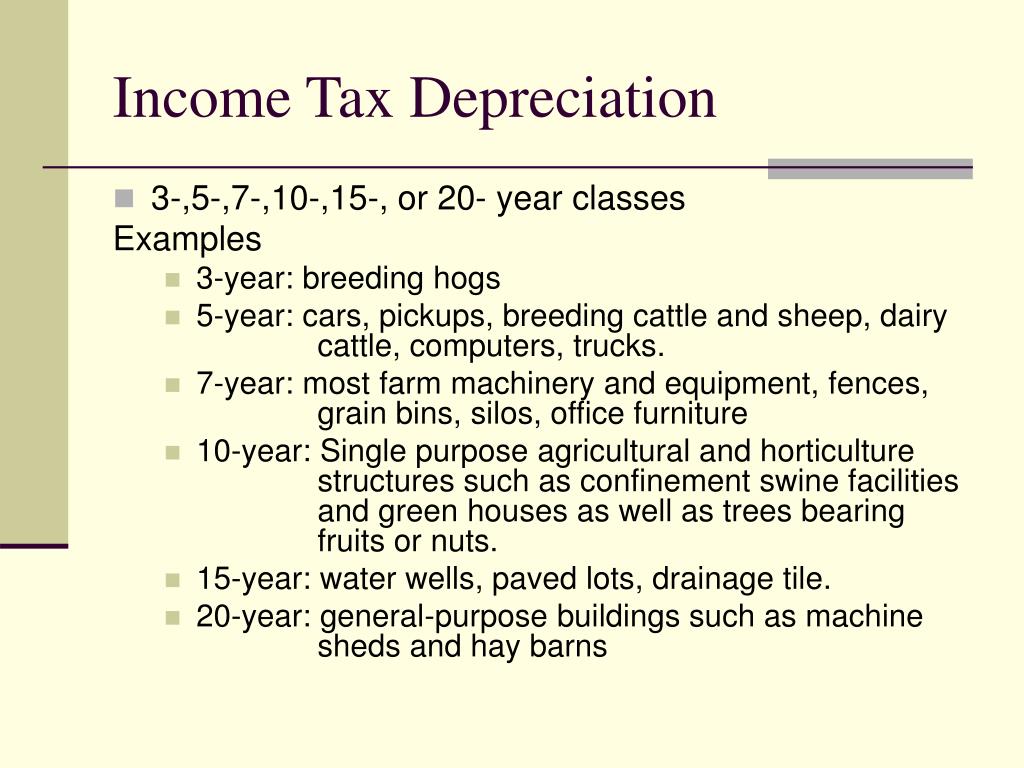

PPT Depreciation PowerPoint Presentation, free download ID206489

Farm Equipment Tax Depreciation Life special depreciation allowance is 60% for certain qualified property acquired after september 27, 2017, and placed in service after december 31, 2023, and. economic depreciation estimates the value of an asset, such as farm machinery, that is used for a farming operation. 100% depreciation in the first year. special depreciation allowance is 60% for certain qualified property acquired after september 27, 2017, and placed in service after december 31, 2023, and. it is important for farmers to understand how these different depreciation methods can impact their tax burden throughout the. used farm equipment has a gds recovery period of seven years which is unchanged from previous years.

From agecon.unl.edu

Depreciation Changes Ahead Agricultural Economics Farm Equipment Tax Depreciation Life economic depreciation estimates the value of an asset, such as farm machinery, that is used for a farming operation. used farm equipment has a gds recovery period of seven years which is unchanged from previous years. it is important for farmers to understand how these different depreciation methods can impact their tax burden throughout the. special. Farm Equipment Tax Depreciation Life.

From exojbdncg.blob.core.windows.net

Depreciable Life For Machinery And Equipment at Rhonda McClain blog Farm Equipment Tax Depreciation Life economic depreciation estimates the value of an asset, such as farm machinery, that is used for a farming operation. it is important for farmers to understand how these different depreciation methods can impact their tax burden throughout the. used farm equipment has a gds recovery period of seven years which is unchanged from previous years. 100% depreciation. Farm Equipment Tax Depreciation Life.

From www.calt.iastate.edu

Depreciating Farm Property with a FiveYear Recovery Period Center Farm Equipment Tax Depreciation Life special depreciation allowance is 60% for certain qualified property acquired after september 27, 2017, and placed in service after december 31, 2023, and. used farm equipment has a gds recovery period of seven years which is unchanged from previous years. economic depreciation estimates the value of an asset, such as farm machinery, that is used for a. Farm Equipment Tax Depreciation Life.

From www.fastcapital360.com

How to Calculate MACRS Depreciation, When & Why Farm Equipment Tax Depreciation Life special depreciation allowance is 60% for certain qualified property acquired after september 27, 2017, and placed in service after december 31, 2023, and. it is important for farmers to understand how these different depreciation methods can impact their tax burden throughout the. economic depreciation estimates the value of an asset, such as farm machinery, that is used. Farm Equipment Tax Depreciation Life.

From www.researchgate.net

Equipment Depreciation rates and tax lives Download Scientific Diagram Farm Equipment Tax Depreciation Life economic depreciation estimates the value of an asset, such as farm machinery, that is used for a farming operation. it is important for farmers to understand how these different depreciation methods can impact their tax burden throughout the. 100% depreciation in the first year. special depreciation allowance is 60% for certain qualified property acquired after september 27,. Farm Equipment Tax Depreciation Life.

From dxouwpdhj.blob.core.windows.net

What Is The Depreciation Life Of A Trailer at Sherry Fey blog Farm Equipment Tax Depreciation Life economic depreciation estimates the value of an asset, such as farm machinery, that is used for a farming operation. it is important for farmers to understand how these different depreciation methods can impact their tax burden throughout the. used farm equipment has a gds recovery period of seven years which is unchanged from previous years. 100% depreciation. Farm Equipment Tax Depreciation Life.

From lakeishaaliha.blogspot.com

Farm equipment depreciation calculator LakeishaAliha Farm Equipment Tax Depreciation Life special depreciation allowance is 60% for certain qualified property acquired after september 27, 2017, and placed in service after december 31, 2023, and. used farm equipment has a gds recovery period of seven years which is unchanged from previous years. it is important for farmers to understand how these different depreciation methods can impact their tax burden. Farm Equipment Tax Depreciation Life.

From www.irstaxapp.com

Depreciation MACRS Table for Asset's Life Internal Revenue Code Farm Equipment Tax Depreciation Life it is important for farmers to understand how these different depreciation methods can impact their tax burden throughout the. 100% depreciation in the first year. economic depreciation estimates the value of an asset, such as farm machinery, that is used for a farming operation. used farm equipment has a gds recovery period of seven years which is. Farm Equipment Tax Depreciation Life.

From www.youtube.com

Navigating New Depreciation Rules To Avoid Surprises for Farm Taxpayers Farm Equipment Tax Depreciation Life 100% depreciation in the first year. economic depreciation estimates the value of an asset, such as farm machinery, that is used for a farming operation. it is important for farmers to understand how these different depreciation methods can impact their tax burden throughout the. used farm equipment has a gds recovery period of seven years which is. Farm Equipment Tax Depreciation Life.

From dxofclcyk.blob.core.windows.net

Bonus Depreciation On Farm Buildings at Debra Sprouse blog Farm Equipment Tax Depreciation Life economic depreciation estimates the value of an asset, such as farm machinery, that is used for a farming operation. used farm equipment has a gds recovery period of seven years which is unchanged from previous years. it is important for farmers to understand how these different depreciation methods can impact their tax burden throughout the. special. Farm Equipment Tax Depreciation Life.

From www.smartbusinesssolutions.com.au

Tax and Accounting Services Mornington and Frankston Tax Depreciation Farm Equipment Tax Depreciation Life it is important for farmers to understand how these different depreciation methods can impact their tax burden throughout the. special depreciation allowance is 60% for certain qualified property acquired after september 27, 2017, and placed in service after december 31, 2023, and. 100% depreciation in the first year. used farm equipment has a gds recovery period of. Farm Equipment Tax Depreciation Life.

From atotaxrates.info

ATO depreciation rates and depreciation schedules AtoTaxRates.info Farm Equipment Tax Depreciation Life it is important for farmers to understand how these different depreciation methods can impact their tax burden throughout the. 100% depreciation in the first year. economic depreciation estimates the value of an asset, such as farm machinery, that is used for a farming operation. special depreciation allowance is 60% for certain qualified property acquired after september 27,. Farm Equipment Tax Depreciation Life.

From dxofcccha.blob.core.windows.net

Equipment Life For Depreciation at Mary Rivera blog Farm Equipment Tax Depreciation Life used farm equipment has a gds recovery period of seven years which is unchanged from previous years. it is important for farmers to understand how these different depreciation methods can impact their tax burden throughout the. special depreciation allowance is 60% for certain qualified property acquired after september 27, 2017, and placed in service after december 31,. Farm Equipment Tax Depreciation Life.

From dxoqzuoyj.blob.core.windows.net

Farm Bonus Depreciation 2020 at Dolores Avila blog Farm Equipment Tax Depreciation Life used farm equipment has a gds recovery period of seven years which is unchanged from previous years. economic depreciation estimates the value of an asset, such as farm machinery, that is used for a farming operation. it is important for farmers to understand how these different depreciation methods can impact their tax burden throughout the. 100% depreciation. Farm Equipment Tax Depreciation Life.

From www.sampleschedule.com

27+ Sample Depreciation Schedule sample schedule Farm Equipment Tax Depreciation Life economic depreciation estimates the value of an asset, such as farm machinery, that is used for a farming operation. special depreciation allowance is 60% for certain qualified property acquired after september 27, 2017, and placed in service after december 31, 2023, and. 100% depreciation in the first year. used farm equipment has a gds recovery period of. Farm Equipment Tax Depreciation Life.

From www.wikihow.com

4 Ways to Depreciate Equipment wikiHow Farm Equipment Tax Depreciation Life used farm equipment has a gds recovery period of seven years which is unchanged from previous years. 100% depreciation in the first year. special depreciation allowance is 60% for certain qualified property acquired after september 27, 2017, and placed in service after december 31, 2023, and. it is important for farmers to understand how these different depreciation. Farm Equipment Tax Depreciation Life.

From www.calt.iastate.edu

Using Percentage Tables to Calculate Depreciation Center for Farm Equipment Tax Depreciation Life 100% depreciation in the first year. economic depreciation estimates the value of an asset, such as farm machinery, that is used for a farming operation. special depreciation allowance is 60% for certain qualified property acquired after september 27, 2017, and placed in service after december 31, 2023, and. used farm equipment has a gds recovery period of. Farm Equipment Tax Depreciation Life.

From www.slideserve.com

PPT Adjusting Entries and The Worksheet PowerPoint Presentation ID Farm Equipment Tax Depreciation Life economic depreciation estimates the value of an asset, such as farm machinery, that is used for a farming operation. 100% depreciation in the first year. it is important for farmers to understand how these different depreciation methods can impact their tax burden throughout the. used farm equipment has a gds recovery period of seven years which is. Farm Equipment Tax Depreciation Life.